Finance Minister Enoch Godongwana’s 2025 National Budget (Version 2.0) reflects a promising balancing act between fiscal consolidation and stimulating economic growth, but significant risks remain, according to Citadel’s Chief Economist, Maarten Ackerman.

“While there are positive elements in the budget – such as plans for greater public and private infrastructure spending, attempts to stabilise debt and a seeming willingness to appease opposition partners in the Government of National Unity (GNU) as South Africa’s democracy matures – several underlying risks could derail the government’s projections, especially if execution on ambitious plans to achieve 1.8% gross domestic product (GDP) growth, falters,” Ackerman warns.

Ackerman provides his top 6 takeout’s from the Budget 2025

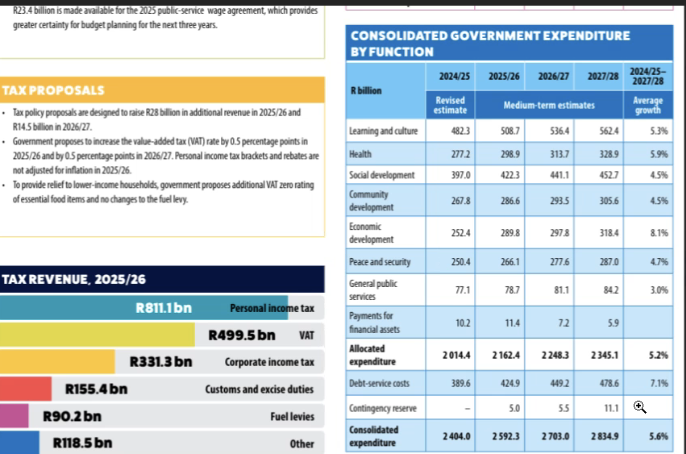

Fiscal risks remain high: The budget does not provide for additional contingency reserves, making South Africa less resilient to any future economic shocks. The contingency liability account remains at R484 billion, posing a significant risk if state-owned entities require further bailouts or any unforeseen crises hit the economy.

Debt levels still a concern: The debt-to-GDP ratio is expected to peak at 76.6%, slightly higher than previous projections. However, these estimates rely on optimistic GDP growth assumptions, which could prove unrealistic given recent economic stagnation. If growth underperforms, debt levels could exceed 80% of GDP, putting additional strain on government finances. One positive feature of the budget, however, is that there is no mention of plans by the government to take on more debt to meet spending pressures in the coming year.

Economic growth projections questionable: Treasury projects 1.9% GDP growth in 2025, despite the fact that 2024’s growth came in at only 0.8%. Growth rates are projected at 1.9% for 2025, 1.7% for 2026, and 1.9% again for 2027. Ackerman warns that if reforms are not implemented effectively, economic expansion could fall short and more much-needed jobs will not be created, affecting revenue collection and worsening the budget deficit.

Infrastructure investment plans are filled with good intentions, but there is uncertainty on execution: The R1 trillion infrastructure investmentplan, particularly intransport, energy, and water, is significant, but its success depends on government’s ability to execute efficiently by creating the right conditions to attract private sector participation. This remains doubtful. While the new public private partnership (PPP) regulations are encouraging, private investors will remain cautious until governance structures – and more specifically, credit enhancement features that will unlock private sector investments – improve.

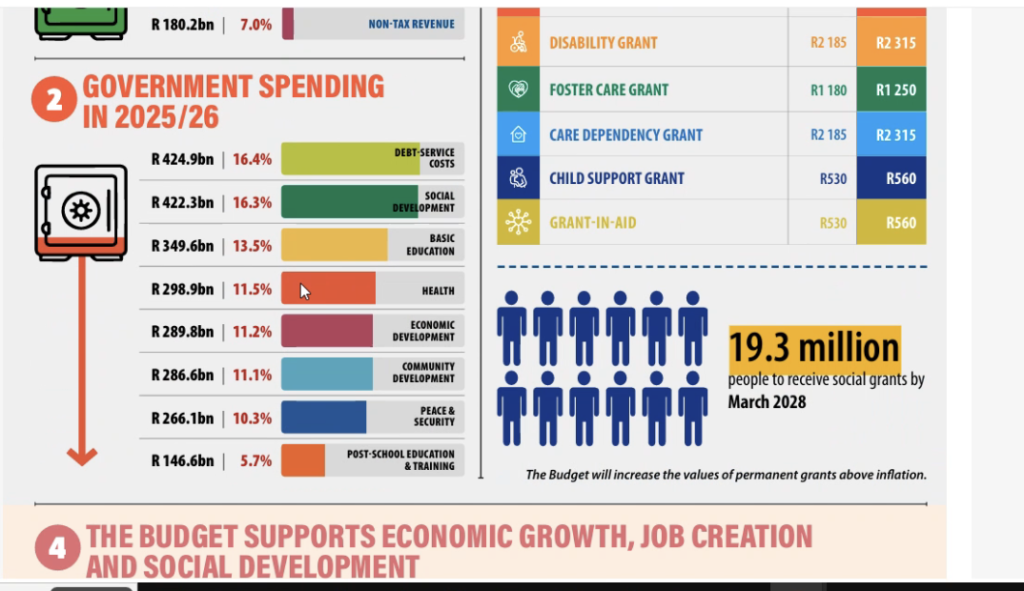

Tax increases and fiscal sustainability: The VAT increase of 0.5% in 2025 and another 0.5% in 2026 reflects the government’s urgent revenue needs, balanced against the political negotiations it is locked in with the other political parties in the GNU. However, higher taxes could further constrain consumer spending and economic activity. Treasury’s decision not to adjust income tax brackets for inflation will also add to financial strain on households.

Political uncertainty and budget rejection risk: With opposition parties already signalling their intention to reject the budget, there is a real risk of delays in implementation. If the budget is not passed, further political wrangling could weaken market confidence and put additional pressure on the currency and bond markets. The rand already weakened by 20 cents since last night on the back of this uncertainty. Overall, while some elements of the budget are positive – such as the commitment to infrastructure development and a primary fiscal surplus – execution on economic growth remains the only silver bullet that could save the economy.